The past 18 months have been a period of unusually stable and uninterrupted growth for Bitcoin. Since its December 2022 low of $16,529, BTC has been on a gradual climb that has seen it more than quadruple in value to reach its current level of $66,459. There have, of course, been lulls and corrections during this time, but for the first time in, well, forever, the original cryptocurrency has managed to make serious gains over time without a clear bubble dynamic forming. The reasons for reduced BTC volatility are manifold, but the big factors in recent years have been increased institutional investment and the implementation of a more sustainable regulatory framework in many major economic regions.

Much of the recent growth, however, has been attributed to a combination of the mass approval of spot Bitcoin ETFs driving inflows from previously untapped markets and anticipation of the next major halving, a phenomenon that occurs about once every four years and sees the block mining reward reduced by 50%. But now that the biggest event in the crypto market calendar for 2024 has finally come and gone, what are the likely implications for both Bitcoin and the wider digital assets market as a whole?

We're halfway there

At some point between 19 April and 20 April, the 840,000th block was finally added to the Bitcoin blockchain, and thus, the much-anticipated fourth Bitcoin halving came to pass. While the immediate response has been somewhat muted (a mere +3.75% gain over the past five days), this is largely because the event had been priced in over the weeks and months leading up to the actual halving. In fact, it's a positive sign that we haven't seen a slight correction as whales have taken their likely sizable profits on the news. Indeed, Bitcoin has already moved up 95.83% in the last six months, and one would have surely expected a mild dip as the anticipation reached its climax.

Whether or not a short-term correction does eventually come about, the historical data from 2012, 2017, and 2020 would suggest that this halving will have a net positive effect on BTC's price in the coming six months. The increased mining difficulty and lower supply that the halving marks are also expected to help control volatility even further. This should have the effect of leading to even wider institutional adoption, which has been facilitated greatly by the advent of the spot Bitcoin ETFs this year. We already saw more than $1 billion in institutional inflows in 2023, and with this new investment vehicle and lower overall risk profile for BTC, this figure could easily be beaten in 2024. In this context, Cathie Wood's famous $1 million Bitcoin prediction could prove well-founded.

Miners' strike

One important side-effect of increased difficulty is the potential impact on miners. Many were already quite overstretched financially amid high energy prices and stricter environmental legislation. Now, the amount of power required to earn one Bitcoin has essentially doubled. One concern is that we could see a similar scenario as in the summer of 2022 when many miners simply downed tools because they could no longer make money. While this would, in theory, buoy prices due to reduced supply, the much slower transaction speeds that it would entail would likely reduce overall transactions significantly.

Another potential threat of lower profitability could be that mining companies begin selling off their BTC reserves to fund operations, thus swelling outflows. Of course, some profit-taking is to be expected anyway, given that Bitcoin is now at an all-time high. However, this should likely normalise over time (barring an escalation in the Middle East leading to even higher energy prices). Then, the expectation is that new, more powerful ASICs will close the technological gap and allow the surviving miners to return to profitable activity.

The one possible spanner in the works for Bitcoin could, in fact, prove to be the Federal Reserve. After months of more dovish rhetoric, the markets had all but accepted multiple rate cuts this year. However, with the current pressure on the dollar, the central bank may be forced to keep rates high for some time, reducing interest in risk assets like Bitcoin.

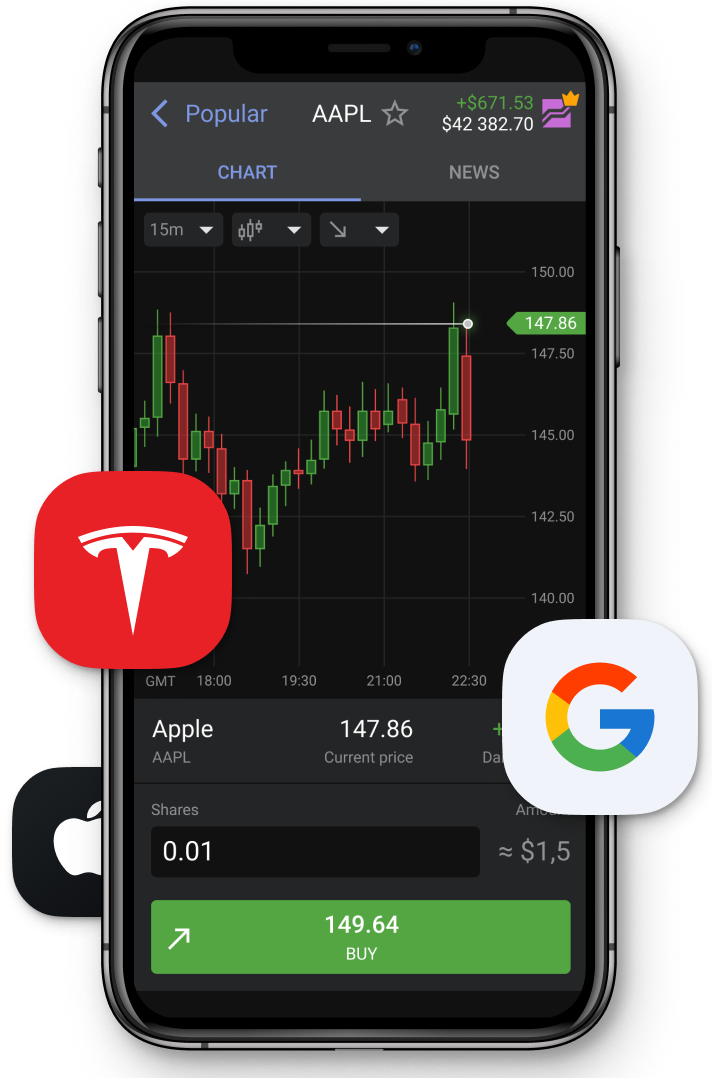

Trade Bitcoin and more CFDs with Libertex

Libertex offers both long and short positions in crypto CFDs, including Bitcoin and the Grayscale Bitcoin Trust. Libertex's trading model means you can open long or short positions, with leverage, in well over 100 crypto CFD pairs. For more information or to create an account, visit www.libertex.org/signup today!